The Motorist Guide on how to file a car insurance claim

Filing a car insurance claim can seem daunting, especially when you're dealing with the stress of an accident. However, understanding the process and knowing what steps to take can make it much easier. In this guide, we'll walk you through how to file a car insurance claim in a straightforward manner. Whether you're dealing with a minor fender bender or a more serious accident, these steps will help you navigate the claims process smoothly.

Before you even need to file a claim, it’s important to understand your car insurance policy. Knowing what's covered and what's not can save you time and frustration later. Policies vary, but here are some common types of coverage:

- Liability Coverage: Covers damages to others if you're at fault.

- Collision Coverage: Pays for damage to your car from a collision.

- Comprehensive Coverage: Covers non-collision related damage, like theft or natural disasters.

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers.

- Uninsured/Underinsured Motorist Coverage: Protects you if you're hit by someone without adequate insurance.

Familiarize yourself with these terms and your policy details to ensure you know what to expect when filing a claim.

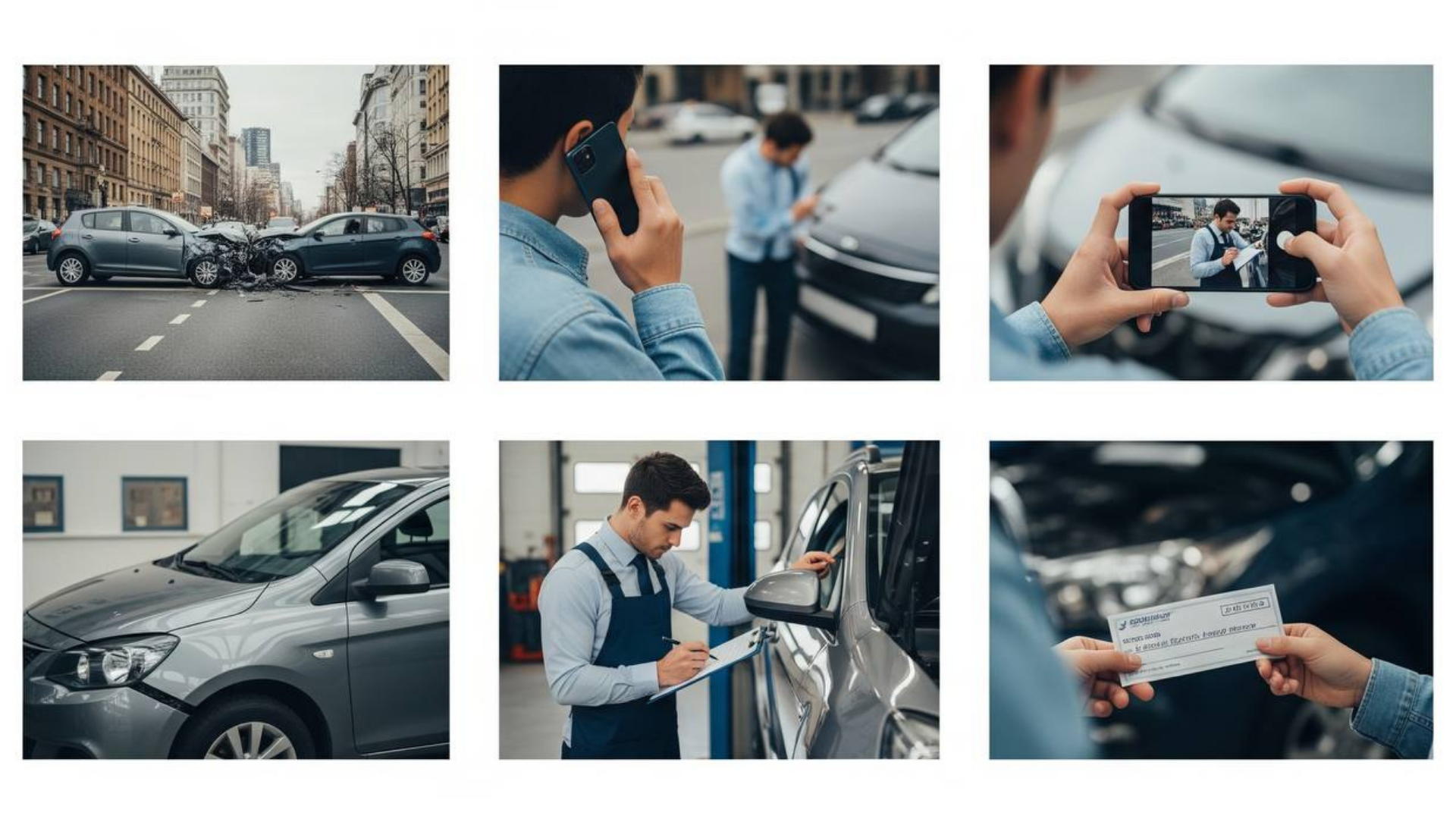

After an accident, the first thing to do is ensure everyone's safety. Check for injuries and call emergency services if needed. Once everyone's safe, you can start gathering information.

Collect as much information as possible from the scene. This includes:

- The other driver's name, contact information, and insurance details.

- Names and contact information of any witnesses.

- Photos of the accident scene, including vehicle damage and any road signs or signals.

- A copy of the police report, if there is one.

Contact your insurance company as soon as possible to report the accident. Most insurers have a 24/7 claims hotline. Be ready to provide:

- Your policy number.

- Details of the accident.

- Information you gathered at the scene.

After reporting the accident, your insurer will assign a claims adjuster to your case. The adjuster's job is to evaluate the damage and determine how much the insurance company will pay. They might:

- Request an inspection of your vehicle.

- Ask for additional documents or information.

- Discuss the settlement amount.

Be cooperative and provide any information they need promptly.

Once the claim is approved, you can proceed with repairing your vehicle. Some insurance companies have preferred repair shops, but you can typically choose your own. Keep all receipts and documentation related to the repairs.

After repairs are completed, your insurer will finalize the claim. This involves:

- Ensuring all paperwork is in order.

- Verifying that repairs are complete.

- Issuing any final payments.

Maintain a file with all the documents related to your claim, including police reports, repair receipts, and correspondence with your insurer. This will make it easier to keep track of everything and resolve any disputes.

Stay in touch with your insurance company and respond promptly to any requests for information. Clear communication can help speed up the claims process and prevent misunderstandings.

Your deductible is the amount you'll need to pay out of pocket before your insurance covers the rest. Make sure you know how much it is and be prepared to pay it when you file a claim.

Regularly review your car insurance policy to ensure it meets your needs. If you find that your current policy doesn't offer enough coverage, consider shopping around for the best car insurance that fits your budget and needs. Look for affordable car insurance options that offer comprehensive coverage at a competitive rate.

If you're filing a car insurance claim in Malaysia, there are some specific steps to follow:

- Lodge a Police Report: Malaysian law requires you to report any road accident to the police within 24 hours.

- Notify Your Insurer: Inform your insurance provider immediately after the accident.

- Submit Necessary Documents: This includes the police report, claim form, a copy of your driving license, and other relevant documents.

- Follow Up: Stay in contact with your insurer to ensure the claim is processed promptly.

Filing a car insurance claim doesn't have to be overwhelming. By understanding your policy, gathering the right information, and following these steps, you can navigate the process with confidence. Whether you're looking for the best car insurance or seeking affordable car insurance solutions, being informed and prepared will help ensure a smoother experience. Remember, regular policy reviews can help you maintain the right level of coverage for your needs, whether you're in Malaysia or elsewhere.

Read More: JPJ in final stages of reviewing demerit points system

I want to find the highest selling price for my car within 24 hours!

Download the Motorist App now. Designed by drivers for drivers, this all-in-one app lets you receive the latest traffic updates, gives you access to live traffic cameras, and helps you manage vehicle related matters.